Expected Utility Theory

Many consider the contemporary study of decision-making from a cognitive perspective to have begun with the publication of the book Theory of Games and Economic Behavior by von Neumann and Morgenstern (1944). These authors proposed a “rational” account of decision making in which choices are made with the goal of maximising what they called expected utility.

For any decision, the expected utility associated with each outcome/option is determined by the probability of that outcome/option multiplied by the subjective value (or utility) of that outcome.

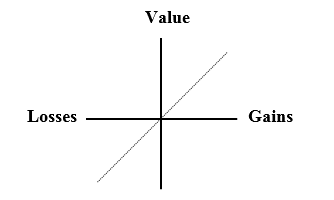

The graph above illustrates the way in which people should weigh outcomes (in terms of value or utility) according to expected utility theory. Consider the following questions:

Question

Are gains and losses weighted equally?

Solution

Yes, a gain of $100 would have the same positive value as the negative value of a loss of $100.

Question

Is an increase in gain from 0 to $50 associated with the same increase in value as increase in gain from $4950 to $5000?

Solution

Yes, value increases linearly with gains, and this rate of increase is constant regardless of previous gains.

Here is a simple calculator for options that have an expected utility of $1000:

You can see from the above that a gain of 2000 with a probability of 50% has an expected value of $1000.

Question

What probability would a gain of 10000 have to be associated with, in order for the option to have the same expected utility?

What amount of gain would be associated with a probability of 90%, in order to have the same expected utility?

Brainstorm

Feel free to play around to see the range of options that all have the same expected utility. While these options have the same expected utility, would they all feel the same to you if you had to choose one of them?

The above example suggests that while the concept of expected utility may be an account of how people should behave, it turns out that it does not always reflect how people actually behave. As shown by Kahneman and Tversky in the 1970s and 1980s, there are factors other than expected utility that play a role in or influence decision-making. We will examine some of these factors throughout the rest of this online tutorial.

Daniel Kahneman (left) and Amos Tversky (Right)